Superannuation

Understanding the Superannuation Death Benefit Calculation

Rather than simply disappearing when someone passes away, a deceased person’s superannuation is generally paid out to a nominated beneficiary or next of kin. But how is it calculated?

In this article, we’ll explore the superannuation death benefit calculation process in detail so you can understand how it all works.

What is the death benefit calculation?

The death benefit calculation is a process that determines the entitlement that a nominated legal representative or beneficiary can receive after a person dies.

The calculation is based on several factors, including how much superannuation the deceased has accrued and how old they are when they pass away.

How is the death benefit calculated?

The death benefit calculation is based on a formula that takes into account how much superannuation the deceased has accrued, the deceased member’s salary, length of service, type of membership and how old they were when they passed away. The formula is designed to provide a fair and equitable amount to the member’s beneficiaries.

The calculation process begins with the determination of the member’s average salary. This is done by taking the average of the member’s salary over the three years prior to their death. The length of service is then taken into account, with longer service generally leading to a higher death benefit amount.

The type of membership is also an important factor in the calculation process. Members with defined benefit membership will receive a different death benefit amount than those with accumulation membership.

Are death benefits calculated monthly?

Death benefits in Australia are typically not calculated on a monthly basis. Instead, they’re usually paid out as a lump sum or income stream to the beneficiaries of the superannuation fund once death has occurred.

While some funds may offer additional benefits or payments that are calculated on a monthly basis, this is rare.

What is included in the superannuation death benefit amount?

The death benefit amount generally consists of the balance of the contributor’s super account, any money in their Additional Employer Contributions (AEC) account, the SANCS basic benefit, the employee financed benefit and the additional benefit (all three of which are calculated based on the total number of years the decreased worked and their final salary).

The death benefit calculation takes all of these components into account to provide a comprehensive picture of the member’s overall financial position at the time of their death.

Example of the death benefit calculation

Superannuation funds provide a range of benefits to their members, including death benefits. These benefits can provide financial assistance to the dependents of a member in the event of their death.

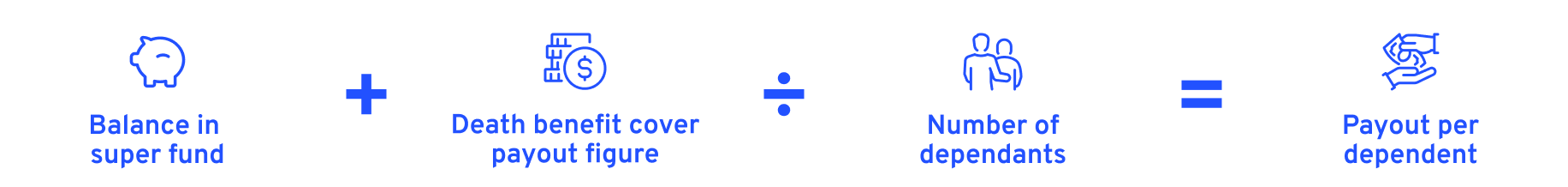

An example of the calculation of a standard payout to dependents is below:

The calculation of a death benefit in Australia can be complex and depends on a range of factors, including the size of the superannuation balance, the number and financial dependency of dependents, and any tax implications. It’s important to seek advice from a financial advisor or lawyer.

Make a superannuation death benefit claim today

LHD Lawyers helps everyday Australians receive the benefits they’re entitled to. Find out more about superannuation death benefits or call 1800 455 725 for a no-obligation consultation about your case.

Author: Khushboo Kang

Original Publish Date: April 26, 2023

Last Updated: February 15, 2024

Check if you’re eligible or get free claim advice now